Published: September 05, 2024

We are pleased to announce the release of our Annual Report and Financial Statements for the year ending 31 March 2024. This report highlights our unwavering commitment to the stewardship of our Partner Funds' assets, underscoring our dedication to responsible investment and engagement.

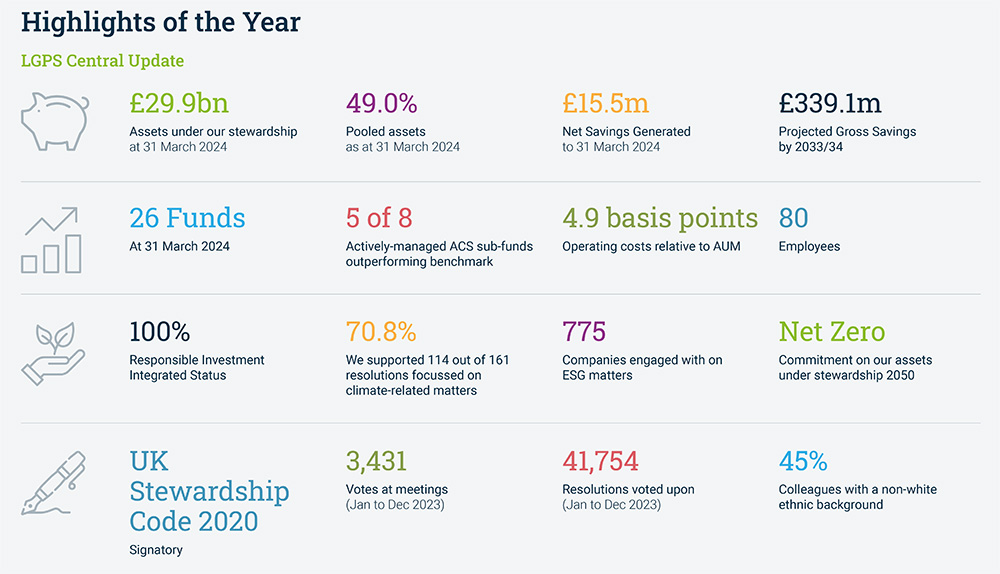

Throughout 2023/24, we made significant strides in delivering pooling, with assets under our stewardship growing to £29.9 billion, up from £26.4 billion the previous year. Of these, £5.2 billion is invested in the UK, including £593 million in UK private market investments, representing 24% of deployed capital. Additionally, over £2 billion of committed funds are available for future investments.

Since the year-end, our Partner Funds' commitments to Private Markets have surpassed the £5 billion milestone, with approximately £500 million in investment proceeds already distributed back to them.

Notably, substantial additional assets are managed within Private Market advisory mandates, now totalling £2 billion, including £1.3 billion in Private Equity. Our third private equity vintage secured £210 million in commitments from five Partner Funds, which has since increased to £315 million after the year-end.

In April 2023, we launched our first direct UK property fund, initially attracting £130 million in commitments from two Partner Funds. By March 2024, this fund had invested in three properties. In addition to our direct UK Property Fund, we have a UK indirect Property Fund with initial commitments of £80 million, focusing on residential assets in the social, affordable, and private rented sectors. We also have a Global Property Fund in the pipeline.

As of March 2024, we leverage our in-house fund management capabilities to manage over £10 billion of our Partner Funds' public markets investments internally. This includes £2.5 billion in newly launched mandates in UK Government Debt (“Gilts”) and £7.5 billion in passive equity funds.

Looking ahead to 2024/25, we will continue to collaborate closely with our Partner Funds on new fund launches, including Buy and Maintain UK Corporate Bonds, while exploring opportunities in Listed Smaller Companies and Natural Capital.

We remain committed to delivering significant cost savings on current and future funds. To date, we have achieved gross cost savings of £89.0 million, with projections to reach £339.1 million by 2033/34.

During the year, we reached a major milestone by achieving breakeven on investment cost savings for our Partner Funds, with cumulative net savings of £15.5 million at the end of the year, and forecasts indicating an increase of £13.5 million annually.

Our commitment to delivering value for money and efficiency is reflected in our team of 80 professionals, who bring diverse backgrounds and expertise to the table. We recognise the benefits that diversity brings, with 45% of our colleagues coming from minority ethnic non-white backgrounds, and 37% being female (2023: 46%; 40%). Additionally, 50% of our Board members are female, up from 33% in March 2023, demonstrating our commitment to increased gender diversity at leadership levels.

Responsible investment is at the heart of everything we do, driven by our engagement strategy. Over the past year, we voted at 3,432 meetings, covering 41,754 resolutions as part of our stewardship of the companies we own on behalf of our Partner Funds. As signatories to the UK Stewardship Code for the fourth consecutive year, we are proud to have achieved 5-star ratings (the highest possible score) in five out of six categories in the latest UN PRI Assessment Report, scoring over 80% in each section. Our third Taskforce on Climate-Related Financial Disclosures (TCFD) report further underscores our commitment to responsible investment. We also assisted our Partner Funds in producing their TCFD reports, showcasing the benefits of a centralised resource and our pool-wide dedication to sustainability.

Our CEO, Richard Law-Deeks, commented, "As long-term investors, we have focused on the steady growth and refinement of our offerings to deliver pooling solutions, ensuring a robust fund portfolio and value-add services. This approach helps us grow assets cost-effectively and build on our solid foundations to support the long-term future of the LGPS in the Midlands."

The full report can be found here.