Published: September 29, 2022

- Short term UK interest rates likely to move higher than expected and remain high for longer

- Recent Sterling weakness is an opportunity to consider hedging non-GBP overseas assets

- Equity market weakness should be an opportunity to dynamically manage any equity protection hedges in place

Last Friday’s UK’s Conservative Government Chancellor Kwasi Kwarteng unveiled their ‘mini budget’ (if ever there was a misnomer!), announcing a £45bn debt-financed, tax-cutting package that sparked a nearly 9% decline in the value of Sterling against the US Dollar, closing on parity. UK Government Bond yields (Gilt yields) rose by over 70 basis points with 10-year bond yields hitting nearly 4.5%, and Sterling money markets pricing in potential short-term rates rising to over 6% by end Q1 2023.

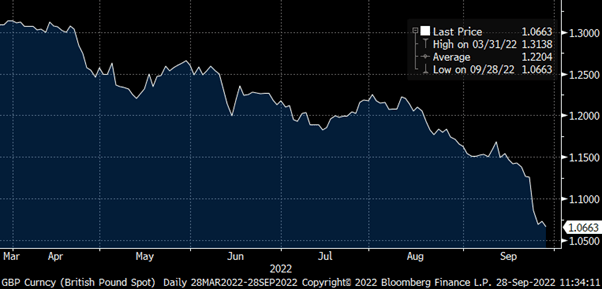

GBP vs USD since 31 3 22 — Bloomberg

This package has outlined the largest tax cuts since 1972 and is designed to improve UK growth prospects; less generous comments might point towards a potential general election to be called within two years.

The market reaction must have taken the Government by surprise and has prompted harsh comments by others including the IMF, warning against tax cutting plans at a time of inflation is near 10% and calling on the UK ‘to re-evaluate its plan for unfunded tax cuts’ and that “it is important that fiscal policy does not work at cross purposes to monetary policy”.

The Bank of England MPC, which had announced a 50-basis points rate increase, smaller than some expected (to 2.25%) the day before the fiscal statement, made an announcement on Monday evening that had been hoped to calm markets. However, it merely referenced that the MPC would make a ’full assessment’ at its next meeting which is not until November, and which dashed the market’s slight hope that an inter-meeting rate increase might have been in the offing (and led to a further GBP decline). The statement re-stressed that the Committee ‘will not hesitate to change interest rates by as much as needed to return inflation to the 2% target’.

With the sizeable twin deficits that the UK currently runs requiring overseas investments to help finance, the trade deficit and will continue to deteriorate if Sterling declines further. The budget deficit will also continue to increase as the cost of domestic government debt (yields) increase. Moody’s has already warned that these deficit expansions are potential credit events implying a threat to the UK’s current AA credit rating.

The latest development has been yesterday afternoon’s statement by the Bank of England stating that it will carry out temporary purchases of long dated UK bonds until 31st October, intended to restore orderly market conditions and that auctions will occur daily from today until 14th October. It was directly intended to ‘bailout’ some pension schemes whose leveraged LDI strategies backed by collateral such as equities, corporate bonds and gilts were needing to top up their collateral and as gilt prices rose, were forced to sell more liquid assets including gilts The move has led to an immediate inversion of the yield curve with longer dated (30 year plus) yields declining by over 100 basis points. Whether this action will bring some order back to the markets is yet to be determined, but at best, it is likely to be a short term ‘plaster’.

So, what are the implications for investors?

First, the fiscal package has almost ensured that interest rates in the UK will have to go higher from current levels and likely stay high for longer than in other major markets/countries – so there will be opportunities in the next few months to place any short-term liquidity monies at higher rates potentially into 2024

Second, as this relative UK interest rate differential (especially to US interest rates) becomes narrower, and eventually means that UK short rates may be higher than those in the US, the value of Sterling will likely rise against the USD and regain some of its value. In anticipation of this, it is a good time to hedge non- Sterling assets into Sterling to protect relative unrealised foreign currency profits accrued from non-GBP market exposure. Since the end of March 2022, Sterling has fallen nearly 25% against the USD (20% since end March 2022)

Lastly, the recent sizeable equity market moves that have seen many markets fall from all-time highs at the beginning of the year, some by nearly 30% to current levels provides those with equity protection strategies in place to look to dynamically manage the ‘hedge’ (re-examine the ‘trigger’ levels and potentially either realise the protection ‘gained’ or reset the trigger.

We will continue to closely monitor market movements and any portfolio changes being made by the external managers of the LGPSC pooled funds. The PAF meeting next Thursday will provide the opportunity to update on how the situation develops from here. Volatility is very likely to be a feature through the coming days.